🇬🇧->🇵🇱 Przejdź do polskiej wersji tego wpisu / Go to polish version of this post

Table of contents:

- Where did this idea come from in the first place?

- Legal Notice

- Strategy tailored to the situation - 10-Year Portfolio

- Emergency Fund

- Retirement Portfolio

- Is this a good plan?

Officially, I declare myself a Middle-aged Man… I’ve settled down, meaning I have a wife, offspring, bought a house, and I’ve got an axe hanging over my head in the form of a mortgage, no longer thrilled by games, parties, or fast cars, and my interest has shifted towards… saving and multiplying those savings. If you’re reading this and you’re in the same boat, virtual high five! Such melancholic reflections, like the above, convinced me to create a new series of posts dealing with the broad topic of finance, saving, and investing those savings. Do I have any education or professional experience in this direction? Of course not! That’s why posts under the banner of My piggy bank can be treated more as financial warnings than advice.

Where did this idea come from in the first place?

As I mentioned earlier, I’m currently at a stage in life where I have some significant decisions to make. A mortgage and having children force one to think about what the future may hold and to prepare for it in the best possible way. At 32, I’m at best inexorably approaching the halfway point of my life, and at worst, I’ve already reached that level. Deep truth? Indeed, deep, but oh so true. The age of around 30 is the perfect time to get a grip and outline a sensible plan for further action. The period of recklessness, living wildly according to the YOLO philosophy and debauchery, has ended… at least for now, because I sincerely hope that this climate will return when I retire 😎 However, to ensure that old age is blissful, I must start securing myself financially now.

It all started with accidentally stumbling upon the podcast and blog Very Personal Finance (Finanse Bardzo Osobiste) by Marcin Iwuc. After reading all the posts on the blog and listening to all the podcast episodes, it was time to buy the book. My wife always says that buying me gifts is very difficult because I don’t need anything, and if I do, I buy it myself. This time I decided to make it easier for her and suggested that she could buy me the book Financial Fortress (Finansowa Forteca) for Christmas, which she did. I read it cover to cover in a month, and here I am! I’m not claiming that reading one book and listening to a few podcast episodes makes me an expert, but it certainly straightened things out in my head, and now I know what actions I need to perform to take care of my future, and I’m writing about it here to share some of that knowledge or to give someone a hint or direction.

Legal Notice

Make sure to read it! - click to expand

The opinions and information contained on this blog do not constitute investment advice, especially “recommendations” within the meaning of the Regulation of the Minister of Finance of 19 October 2005 on information constituting recommendations regarding financial instruments or their issuers (Journal of Laws of 2005 No. 206, item 1715).

The purpose of such posts is to describe my thoughts on investing and share how I do it and what my strategy is. Everyone has a different financial situation and different risk-taking tendencies, which means they will tolerate losses differently, but also achieve different profits. For some, the latter is often worse, as a one-time lucky strike (coincidence) may lead to investing an even larger sum of money, or even getting into debt to increase the scale of investments, which, with less luck than the first time, can lead to bankruptcy and serious trouble. Therefore, you should only invest with the appropriate knowledge and understanding of the subject. If you do not fully understand the topic, do not invest in specific assets until you understand how they work, or switch to safer forms of multiplying your saved money altogether.

Strategy tailored to the situation - 10-Year Portfolio

Everyone is in a different financial situation, has different priorities, risk tolerance, and above all, different goals and plans to achieve them. My situation is such that I have just taken out a mortgage to buy a house, which formally will be with me for the next 30 years. However, long before signing the contract at the bank, my wife and I decided to do everything to pay it off no later than in 20 years (or, of course, earlier if possible, but let’s stick to 20 years). We plan to achieve this by diligently setting aside a certain amount of money each month for the purpose of overpayment, which we will make after the end of the 10-year period covered by subsidies from the Bezpieczny Kredyt 2% (ang. Secure Loan 2%) program, and which will result in shortening the loan period from 360 to 240 months. Why exactly after 10 years? The subsidy period in the BK2 program lasts exactly that long, and during this period, the resulting interest rate on our loan will be around 2%. However, after its expiration, we switch to a variable interest rate, which will be WIBOR (or WIRON if introduced by that time) + the bank’s margin, which is determined at the time of signing the contract and will be 2.1% for us. So even if the WIBOR index is 0% (which is unlikely), our interest rate will still increase. Because of all this, our plan is to overpay and reduce the remaining capital to be repaid, resulting in the fact that the higher interest rate will be calculated from a smaller amount remaining to be returned to the bank, thus it will be correspondingly smaller.

The strategy involves not only saving but also multiplying the accumulated sum over this 10-year period. From my calculations, it turned out that to achieve our plan, we need to save exactly 1 000 PLN each month for 10 years, which amounts to a total of 120 000 PLN, and anything we manage to earn above this amount will be a very pleasant addition. It seems to me that I have set a fairly realistic investment goal, which assumes that my portfolio will achieve returns exceeding inflation by 3%. It is impossible to predict what inflation will be in the coming months, not to say years, so theoretically, let’s assume that over the 10-year period, it will average 2.5%, which is the target that the NBP (National Bank of Poland) should aim for. In this case, the model portfolio, reflecting my assumptions, should reach a value of around 150 000 PLN in 10 years.

In summary, we can assume the following assumptions for the 10-Year Portfolio:

-

Goal - to pay off the mortgage 10 years earlier.

-

Timeframe for achieving this goal - 10 years.

-

Method of achievement - overpayment of the mortgage using savings accumulated over this period and multiplied through investing.

-

Amount necessary to achieve the goal - 120 000 PLN.

-

Way to gather this amount - saving 1 000 PLN monthly for 120 months (10 years).

-

Expected (model) profit - 3% above inflation.

-

Projected end result - gathering 150 000 PLN assuming average inflation at 2.5%.

-

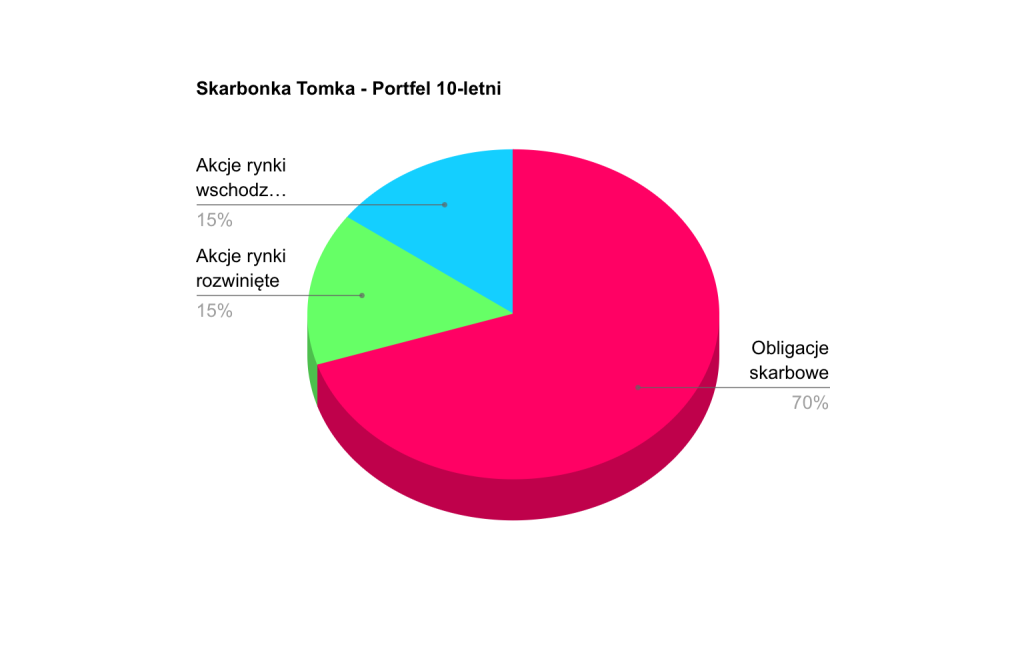

Probability of achieving the goal - I think it’s quite high.

How I’ll invest within this portfolio will probably change because a 10-year portfolio can’t really be called long-term, so the method of establishing fixed weights for individual assets and sticking to them in anticipation that markets are cyclical and sooner or later each asset will peak won’t work here. I need to optimize the investment strategy so that after exactly these 10 years, I’ll have accumulated as much funds as possible, which I’ll withdraw and use to overpay the mortgage through a single shot made precisely between the 120th and 121st installment of my loan. It seems to me that initially, I’ll take advantage of the fact that you can still get high-yielding treasury bonds, which will probably soon become obsolete because inflation is clearly falling. So I’ll pump into bonds as much as possible while they’re good, and then I’ll see. I think the final model portfolio, the one I’ll be aiming for, will consist of 70% treasury bonds, 15% stocks from developed world markets, and 15% stocks from emerging world markets.

Emergency Fund

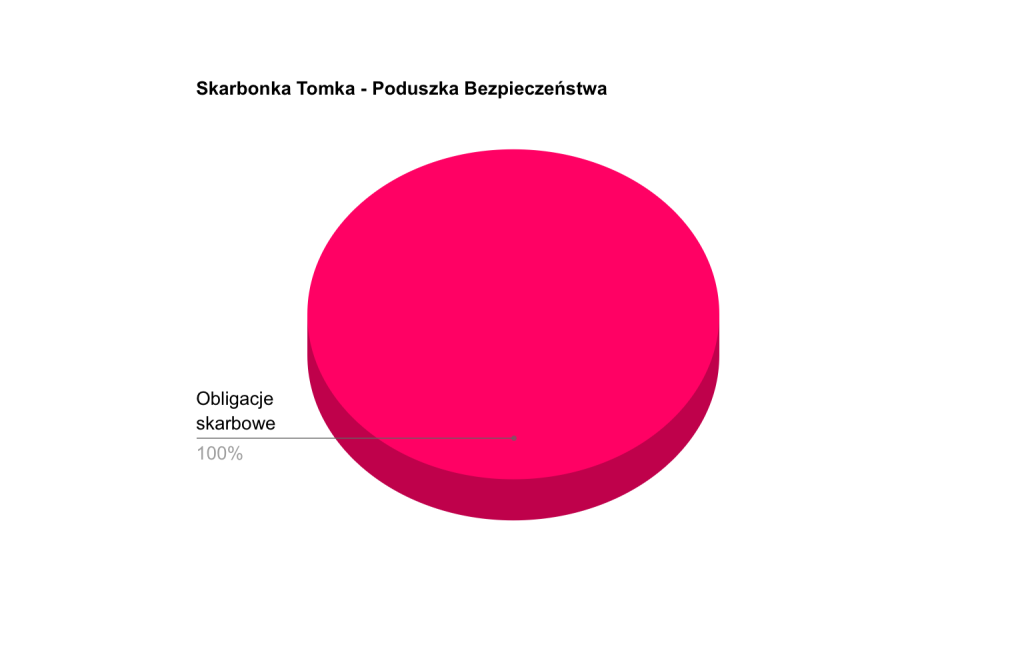

From the book Financial Fortress, I learned that besides the main investment portfolio, I also need, and perhaps first and foremost, something that will secure me and my family in case of unforeseen events. Marcin Iwuć (the author of the book) aptly named such capital the Emergency Fund. Such an emergency fund is nothing more than a certain sum of money serving as a reserve, which we use only in truly crisis situations. It can be invested, but in a way that aims to maintain its value and limit the risk of loss. Additionally, access to this money should be almost immediate, so we do not invest it in assets that are difficult to liquidate or require time to liquidate. Some may argue that access should be within 1-2 days, but I have chosen to accept a 5-day timeframe to access the full value of the emergency fund. This allows me to invest the entire value of my Emergency Fund in treasury bonds, even long-term ones, but I’ll discuss this in another post dedicated to bonds.

Alright, but how much should such an emergency fund be? It’s a totally individual matter. Everyone needs to determine for themselves what amount set aside for a rainy day will give them peace of mind. For some, it might be 5 000 PLN, for others, 50 000 PLN. I’ve assumed that I need security in the amount of approx. 30 000 PLN, which should allow me to survive even 6 difficult months, as I’ve estimated that my fundamental monthly expenses amount to approx. 5 000 PLN.

Let’s now summarize the assumptions regarding the Emergency Fund:

-

Goal - to provide security for surviving 6 months in case of a difficult situation.

-

Amount - approx. 30 000 PLN, which may be modified in the future.

-

Access - to be slightly restricted to resist the temptation to use this money except in emergencies, but in urgent cases, access should be as fast as possible, no longer than 5 days.

-

Protection against loss of value due to inflation, i.e., instead of depositing it into a non-interest-bearing account or a sock, it should be invested in a way that at least maintains its value in line with inflation.

-

Investing safely, i.e., minimizing the risk of total loss of these funds or even a larger drops.

We now know the basic tasks of the Emergency Fund, the required access to it, and its size, so now we need to consider how to store it. Marcin Iwuć suggests in his book allocating 25% of this sum to deposits and/or savings accounts and 75% to inflation-indexed treasury bonds. However, I hate financial products like savings accounts, and deposits will never even keep up with inflation, let alone outpace it. I understand the approach of investing 25% of the emergency fund’s value in these investment forms because they allow very quick withdrawal and access to these funds. However, remember that this also has a downside: while you can break a deposit at any time, unfortunately, it means losing all accrued interest (in theory, not completely all, because the interest rate drops to, for example, 0.1%, and there will be some interest, but it’s pennies, so it’s not worth considering). With treasury bonds, it’s a bit different because while you can’t withdraw money from them in 1-2 days, it’s more like 5-7, but with early bond redemption, we only lose the amount specified in the issuance document, e.g., 0.70-2 PLN per 100 PLN bond, but all profits earned up to the point of early redemption are paid out to us. That’s why I intend to keep my entire Emergency Fund in inflation-indexed treasury bonds.

Retirement Portfolio

In addition to the 10-year Portfolio and the Emergency Fund, I’ve decided to maintain a third one, which I tentatively call the Retirement Portfolio. I’ve already expressed my opinion on retirement with ZUS for my generation in the post Plan for retirement - PPK, PPE, IKE and IKZE (pt. 1) (unfortunatelly it hasn’t been translated to English), specifically in the subsection Polish pension system. In short, considering the current demographics and tax system in Poland, I don’t believe I’ll be able to rely on retirement benefits that will allow me to live decently in old age, even though I work under an employment contract and pay quite high contributions. That’s why I need to start acting now and save money that I will use after the age of 65.

Assumptions of the Retirement Portfolio:

-

Goal - to ensure a decent life in retirement.

-

Timeframe - until reaching the age of 65 and retiring, i.e., 33 years from now.

-

Execution method - regular, monthly saving of a certain amount of money, which will be multiplied over the years and, thanks to compound interest, will allow for accumulating a quite decent sum.

-

Expected return - inflation + 5%.

-

Access - emergency access before the age of 65, but ideally not before.

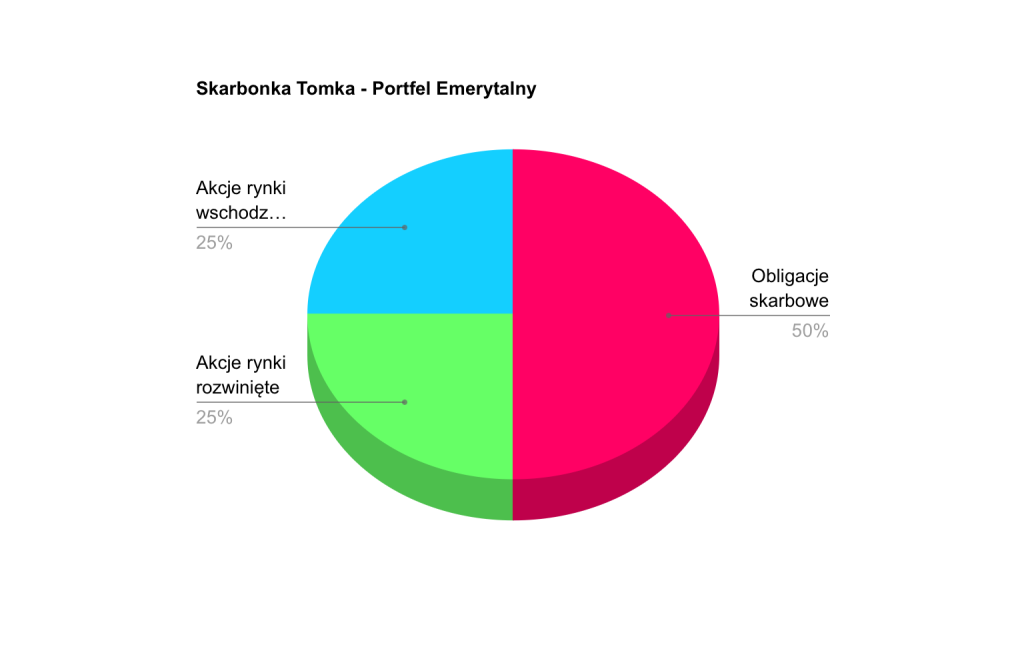

This portfolio will be inherently slightly more aggressive since I still have some time until I reach the age of 65 and can experiment a bit. This is a well-known tactic that involves adjusting the risk level depending on one’s age. This system assumes that a 20-year-old should invest only 20% of their savings in assets considered safe (e.g., bonds, deposits, or gold) and as much as 80% in assets with a much higher risk level (e.g., stocks, commodities, or currencies). Similarly, for an 80-year-old, this proportion would be reversed, i.e., 80% safe, and 20% risky. Assuming these premises, only a 100-year-old should switch everything to bonds. Of course, I don’t plan to be that crazy, so I’ve decided to split this portfolio 50/50. 50% of its value will consist of treasury bonds dressed in a tax umbrella such as IKE (which I’ve written about before), and the other half will be invested in stocks in the most diversified way possible. I’ll expand on this topic in one of the upcoming posts that I have planned. So, I envision the model composition of the Retirement Portfolio as follows - 50% treasury bonds, 25% stocks of developed world markets, 25% stocks of emerging markets.

Is this a good plan?

What do you think about my investment plans? I would be delighted to read the opinions of those more experienced in this matter. However, if there are any questions, I will gladly answer them, of course to the best of my ability. In the next posts, I intend to delve deeper into the topics of treasury bonds, investing in stocks through the purchase of ETFs and index funds, and maybe I’ll write a few words about gold. The rest of the assets are not within my area of interest at the moment, so I do not plan to write about them.

![My piggy bank: Investment portfolio [ENG 🇬🇧]](/images/portfelinwestycyjny.png)